The Wakelin Property Report

5 factors that will shape Melbourne Property Investment in 2024

by Wakelin Property Advisory

Published February 2024

Download for free now

Your Details

CONTRIBUTORS

INTRODUCTION

Capitalising on Melbourne property’s next growth phase

As we edge further into 2024, the Melbourne property market is bracing for a pivotal shift.

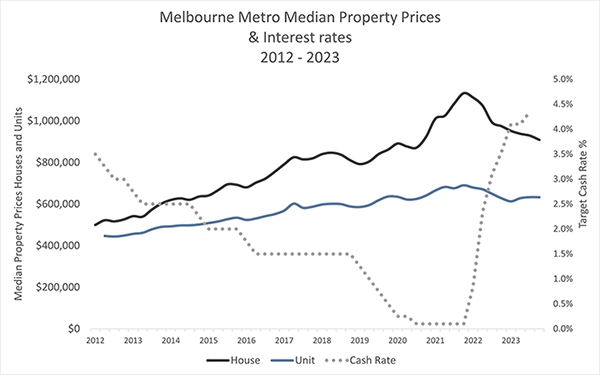

Interest rates, after a period of sharp increases that tempered market activity in 2023, are predicted to soften, setting the stage for a resurgence in demand, supply, and overall market vitality.

Despite the financial strains of the past year, Melbourne’s property market demonstrated remarkable resilience. Dwelling prices climbed by 3.5% amidst challenging economic conditions, though still trailing the peak highs of March 2021 by 4.1%.

This resilience underpins a solid foundation for growth as we step further into the year, with market conditions stabilising and gradually building momentum for an upswing in the latter half.

The trajectory towards growth, however, will be measured.

Historically, the market takes approximately six months to respond to initial interest rate reductions.

At Wakelin, we anticipate a period of equilibrium in early 2024, eventually giving way to a steady climb in property values. We project Melbourne dwelling values to see an annual price increase of between 3-6%.This will build strong momentum, which will intensify into 2025.

With Melbourne’s rental market continuing to surge, the coming months are an invaluable window for strategic planning and market research as the sales market gathers pace.

Download Wakelin’s 2024 Property Report and let it be your compass on this journey. We identify the key factors impacting Melbourne property investment in 2024. Then with our expert panel we offer key insights and strategies to navigate them with confidence and clarity.

Jarrod McCabe, Director

FACTOR NUMBER 1

Interest rate shifts

The Melbourne property market is at an inflection point as it grapples with the implications of the anticipated softening of interest rates. After a volatile two years marked by aggressive rate hikes, the landscape for 2024 is shaping up to be one of cautious anticipation. 71% of real estate professionals identify interest rate changes as the most influential factor for the housing market in the coming year, underscoring the critical role of monetary policy in real estate dynamics, according to a CoreLogic survey.

The Reserve Bank’s current position

Recent commentary from RBA Governor Michele Bullock sheds light on the bank’s cautious approach to interest rate adjustments. Despite some market anticipation of rate cuts in the latter half of 2024, the RBA’s strategy is closely tied to long-term inflation targets, suggesting a slower path to rate normalisation than some investors might hope for. This stance necessitates a well-informed, strategic approach from investors navigating the current phase of Melbourne’s property market.

ON-GROUND ADVICE

Australia’s investment lending has been resilient amid tight borrowing

“High-income earners continue to navigate the market with ease, thanks to their sustained borrowing capacity. In contrast, middle-income investors find themselves sidelined, bearing the brunt of high interest rates and tighter lending criteria. This scenario underscores a growing divide, amplifying the wealth gap in Australia’s property investment landscape.”

Finance expert

The perils of predicting: Interest rates and the lessons of hindsight

It’s imperative to approach interest rate forecasts with caution, regardless of their source, including the Reserve Bank of Australia (RBA).

This cautionary stance is underscored by the experience during the pandemic when then-Governor Philip Lowe assured that the historically low rates of 0.1 percent would remain unchanged “until 2024 at the earliest.” Yet, as we’ve seen in early 2024, the cash rate has climbed to well above 4%.

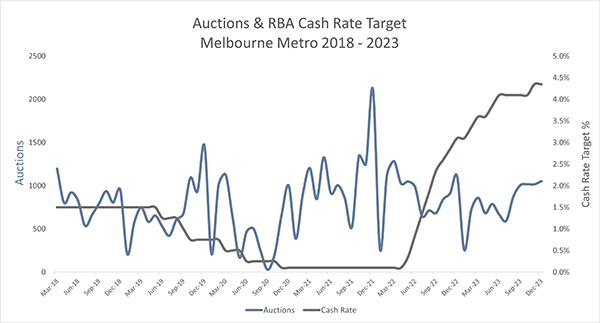

Market dynamics and interest rate fluctuations

The past two years have seen the Australian property market heavily influenced by rising interest rates, leading to a pullback from many potential buyers amid financial uncertainties. This, coupled with sellers’ reluctance to enter the market due to reduced demand, resulted in a constrained supply that put a floor under property prices.

With the eventual easing of interest rates, we anticipate a revival in buyer confidence, sparking increased market activity and competition. Sellers, previously hesitant, are expected to enter the market in response to greater buyer activity and demand.

Source: CoreLogic and RBA

However, it’s essential to set realistic expectations regarding the pace of market recovery. Historical data, such as the period following the mid-1996 rate cuts, shows that the market may take about six months from the onset of rate reductions to truly accelerate.

As interest rates begin to decline, we can anticipate a boost in buyer confidence, spurring increased activity and competition within the housing market. Vendors, who may have been hesitant, are likely to react positively to this change.

However, it’s important to manage expectations regarding the speed of the market’s response. Typically, it can take up to six months following the initial decrease in rates for the market to truly gain momentum.

Reflecting on historical trends, for example, after a decrease in rates starting in mid-1996, it wasn’t until the early months of 1997 that the market began to show significant activity. This delay set the stage for a major boom in housing, which established a foundation for considerable capital gains that persisted for the next twenty years.

Source: REIV and RBA

Download the full report for access to strategic buying and selling techniques amid interest rate shifts

Download for free now

Your Details

FACTOR NUMBER 2

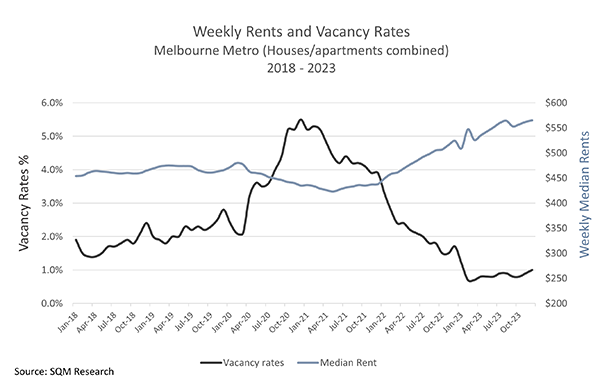

Melbourne’s surging rental market

Melbourne’s rental market is surging. Early 2024 has seen momentum continue to intensify on the back of escalating demand seen over the previous two years. Driven by an unusually low vacancy rate coupled with a tight supply of rental properties, this period offers investors a golden window to achieve premium rental rates and maximise their investment returns.

Analysing rental market dynamics

The vitality of Melbourne’s rental market is clear to see, with strong crowds at property inspections and consequent significant rent hikes in early 2024. This surge, a typical early-year phenomenon, has been magnified by prevailing low vacancy rates and scarce supply, presenting an opportune moment for investors to demand higher rents, which is particularly advantageous for those with newly acquired properties or those poised for early-year lease renewals.

Download the full report for access to strategies to capitalise on premium rental rates

Download for free now

Your Details

The current buoyancy in market activity empowers investors to pursue ambitious rental pricing. Owners have the ability to push higher for rental pricing, but must still ensure they are ready to adapt based on market feedback. Striking the right balance between aiming high and staying grounded helps protect against any gaps in rental revenue.

ON-GROUND ADVICE

Securing top tenants, delivers maximum returns.

“Securing quality, long-term tenants is often more valuable than the highest possible rent. Competitively pricing within the market encourages a broader pool of applicants, allowing for a more discerning tenant selection process. Efficient management of maintenance requests fosters longer tenancies and minimises re- easing costs. In essence, mastering the rental market involves strategic marketing and diligent property upkeep. This approach ensures properties stand out to desirable tenants, optimising rental yields in Melbourne’s competitive landscape.”

Surveying Melbourne’s property landscape

Evolving issues and trends

As Melbourne navigates through the complexities of 2024, several key issues beyond interest rates and rental dynamics warrant attention from property market investors. These were evident in 2023, but will evolve in the year ahead, particularly given the overall changes in market conditions aforementioned. Understanding these factors will be crucial for investors looking to adapt and thrive in the evolving landscape.

FACTOR NUMBER 3

Navigating regulatory and economic uncertainties

Investors must also keep a close eye on regulatory changes and economic uncertainties that could impact the property market. Changes in taxation at a state level have already hurt property investors. While at a federal level, potential new housing policies, such as phasing out negative gearing continue to be talked about by commentators and certain sections of politics. Such changes influence investment strategies and market dynamics. Investors must be on the front foot and understand how any shifts directly impact their property portfolio and finances. Additionally, global economic trends and local economic indicators will play a crucial role in shaping investor sentiment and market activity.

FACTOR NUMBER 4

Supply constraints intensify

The persistent low supply of properties in the market, compounded by construction not keeping pace with population growth, remains a critical challenge. This issue is expected to persist into 2024, potentially limiting the availability of investment-worthy properties and maintaining upward pressure on prices in sought-after areas.

FACTOR NUMBER 5

Demand for renovated properties

The preference for move-in-ready homes is intensifying, driven by the rising costs and logistical challenges of renovation projects. This trend continues to offer an avenue for investors to focus on upgraded properties, which can attract a higher tenant demand and potentially command premium rental rates. It’s important to understand the considerations that should be taken into account when deciding if, when and how to renovate your property, from both a sales and rental perspective. Is it worth renovating yourself, or instead targeting properties that offer the appeal of modern living without the immediate need for further investment in renovations.

ON-GROUND ADVICE

Stay agile and informed as the market evolves

“For Melbourne property investors looking ahead to 2024, strategic planning and market awareness are paramount. Engaging early with real estate agents is a crucial step, offering a first look at exclusive investment opportunities before they become widely available. This forward-looking approach, combined with the strategic timing of loan pre-approvals ensures investors are well-placed to take advantage of the market’s early activity.”

Brenton Potter, Melbourne property acquisition expert

Download the full report for access on ground advice property acquisition advice in the evolving market, and more insights to guide your investment decisions in 2024 and beyond.

Download for free now

Your Details