The Wakelin Melbourne Property Report 2026

Investor Interest Surged 87%. Then Came a Rate Rise. Will Confidence Hold?

by Wakelin Property Advisory

Published February 2026

Download for free now

Your Details

What You’ll Discover

Melbourne’s property market enters 2026 at an inflection point. This report draws on Wakelin’s proprietary enquiry data – a leading indicator of where serious capital is moving before it shows up in price indices – to reveal what actually shifted in 2025 and what it signals for the year ahead.

The data shows investor enquiries surged 87 per cent year-on-year. Interstate buyers moved first – investors from Sydney and Brisbane who looked at Melbourne’s value gap and acted. By the second half of 2025, Victorian investors were starting to follow. Then rate expectations shifted, confidence wobbled – and in February, the RBA raised rates for the first time since 2023. Where does that leave Melbourne’s recovery?

In this report, we examine six questions that will shape Melbourne’s trajectory in 2026 and beyond:

1

Will Melbourne property confidence consolidate or waver in 2026?

– The push and pull between strong fundamentals and fragile interest rate sentiment.

2

How are Policy and Politics Shaping Investor Sentiment?

– Have the tax and regulatory shocks finally been absorbed? And what’s next on the horizon?

3

Rent vs. Buy in Melbourne: Will the Math Shift the Market in 2026?

– Rental pressure meets new pathways to ownership

4

Can Melbourne apartments finally narrow the gap on houses?

– Why the search for value is turning to low-rise apartments on scarce land.

5

Will new infrastructure shift Melbourne property demand?

– How new transport links and activity centre planning are reshaping Melbourne’s property map.

6

How Are AI and Socials Reshaping Property Discovery?

– The emerging tools changing how the next generation finds value.

What Is Wakelin’s Data Telling Us About Melbourne’s Investment Landscape?

Why is Wakelin’s data a leading indicator for Melbourne property investment?

Wakelin Property Advisory tracks enquiry data across its client base – investors and owner-occupiers seeking property in Melbourne’s inner and middle-ring suburbs. This is not mass-market data. It captures what serious, capitalised buyers in the investment-grade segment are doing: purposeful decisions about established housing stock in quality locations.

These buyers tend to move before the broader market. Enquiries precede transactions; transactions precede settlements; settlements eventually appear in price indices. What shows up in Wakelin’s data today may take months to register in aggregate statistics.

How did Melbourne investor sentiment shift in 2025?

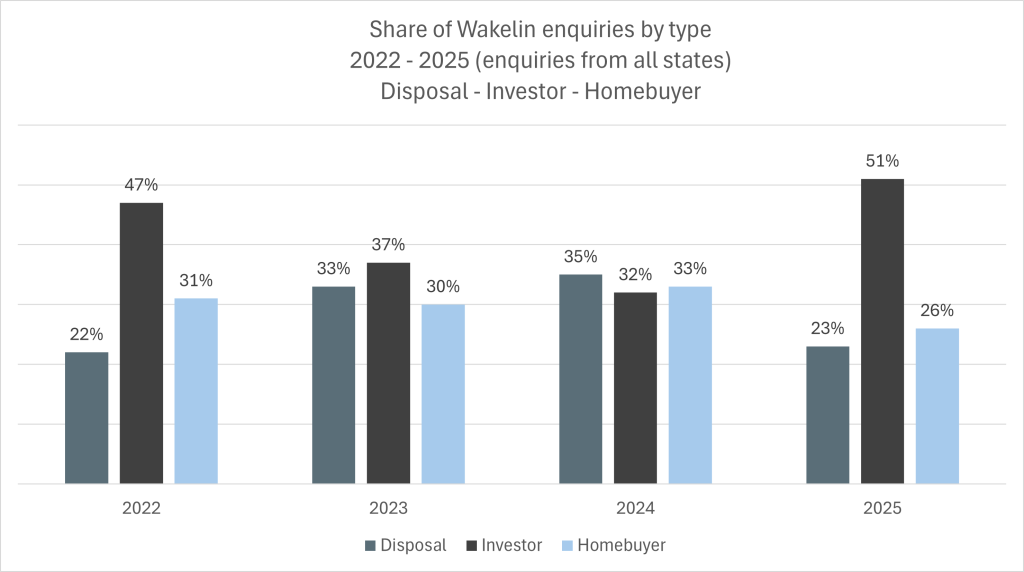

Wakelin’s enquiry data for 2025 shows a clear shift back towards investors.

- Investor enquiries rose 87 per cent year-on-year in volume

- Investor share of total enquiries reached 51 per cent – the highest since tracking began in 2022

- Disposal enquiries – existing owners seeking to sell – dropped from 35 per cent to 23 per cent.

The chart below shows how the composition of all Wakelin enquiries nationally has shifted between 2022 and 2025, with investors now taking the largest share of activity.

Investors are returning, and the exodus triggered by land tax changes appears to have largely run its course.

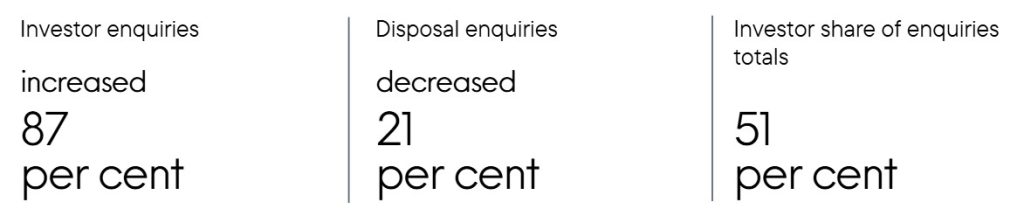

How has Victorian investor sentiment evolved this decade?

When we zoom in on Victorian enquiries only, we can see how local sentiment has shifted so far this decade. Tracking activity back to 2020 shows investor enquiries surging through the COVID boom, peaking in 2022, then softening as policy shocks and rate rises hit sentiment. The 2025 rebound – with investor enquiries climbing back toward 65 per cent of Victorian activity – suggests the cycle may be turning again.

Share of Victorian enquiries by type. Investment enquiries peaked in 2022, fell through 2023-24, then recovered to 65 per cent in 2025.

Download for free now

Your Details

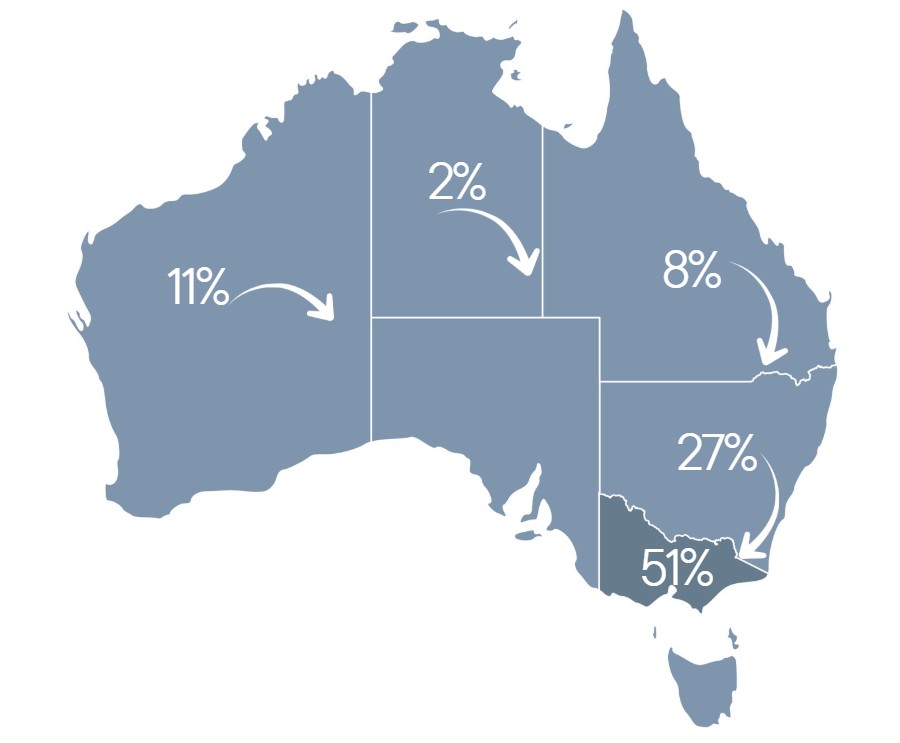

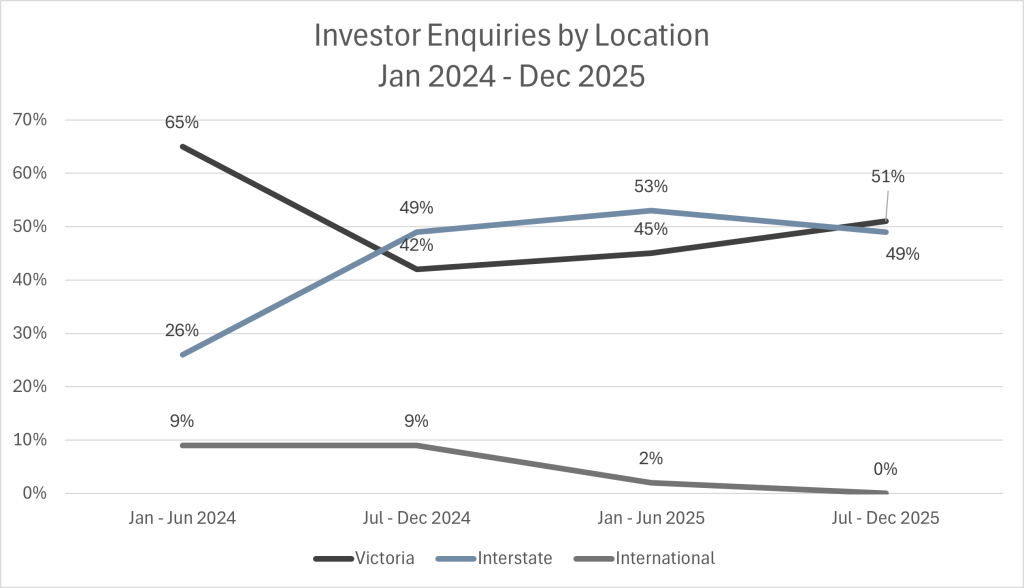

Where is Melbourne investment capital coming from – and how did it shift in 2025?

The composition of investor enquiries shifted meaningfully through 2025:

- First half: interstate investors 53 per cent, Victorians 45 per cent

- Second half: Victorians 51 per cent, interstate 49 per cent

- New South Wales remained the largest interstate source at approximately 27 per cent

- Western Australia emerged strongly, from negligible to 11 per cent

- Queensland cooled, from 15 per cent to 8 per cent

Investor enquiry composition, H2 2025. Victoria recovered from 45 per cent in H1 to 51 per cent – reclaiming the lead from interstate.

The early 2025 story was interstate-led. Investors from Sydney and Brisbane – markets that had run hard – looked at Melbourne’s value and acted. That interstate activity appeared to reignite confidence among local investors. By the second half, early signs of Victorians returning were visible in the data.

Whether that continues is uncertain. The shift in rate expectations through December and the February rate rise may have unsettled confidence before it consolidated. What we can say is the beginnings of a local return were there – worth watching as 2026 unfolds.

Share of investor enquiries by origin. Victorian share fell from 65 per cent in H1 2024 to 42 per cent by H2 2024, before recovering to 51 per cent by H2 2025. Interstate peaked at 53 per cent in H1 2025.

How does Wakelin’s data compare with the broader Melbourne market indices?

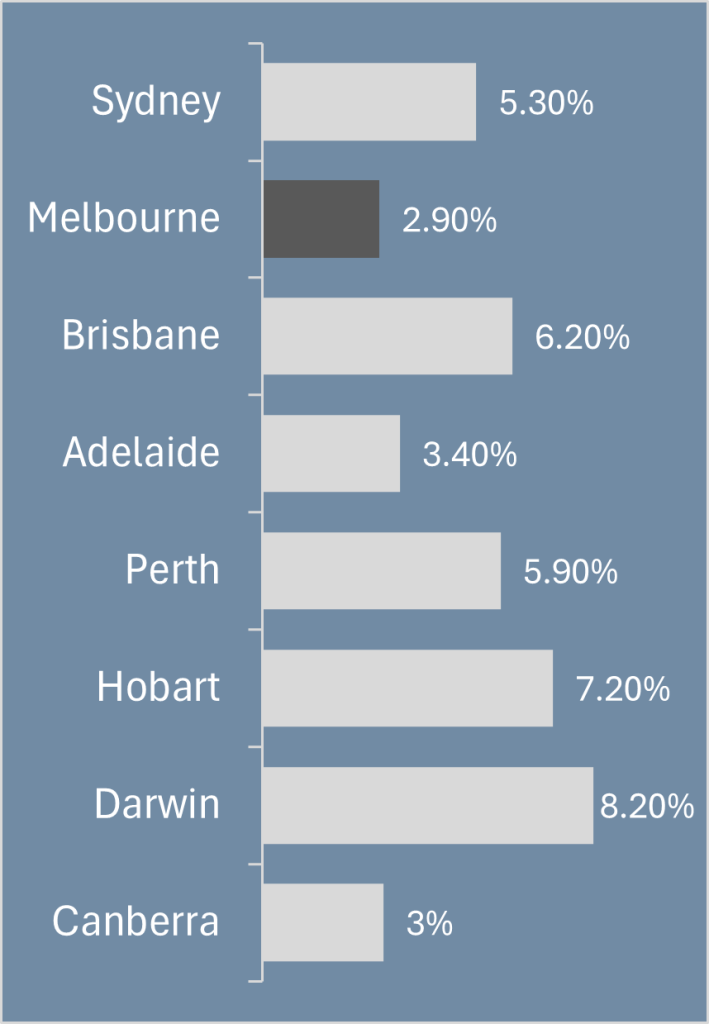

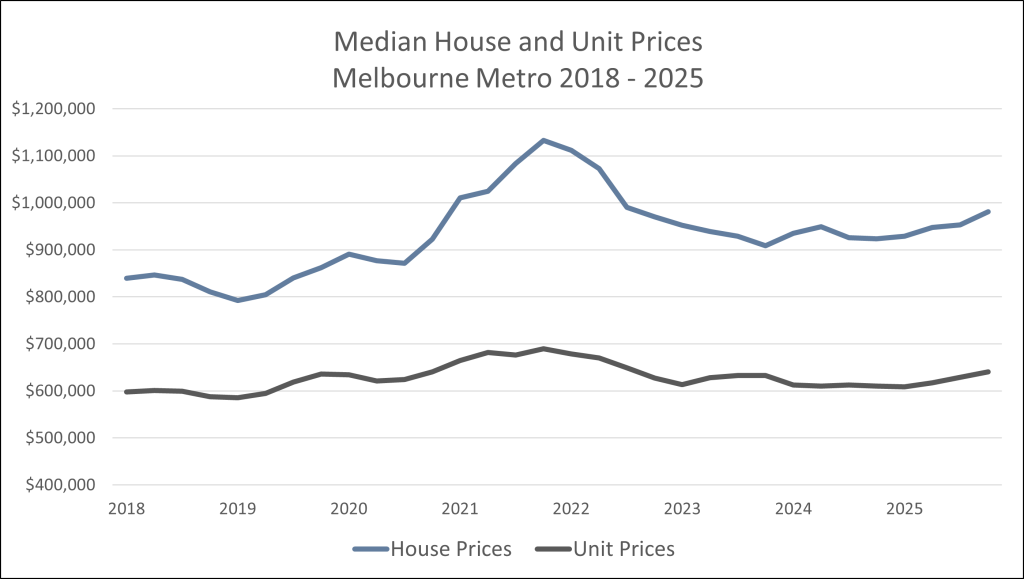

Different data sources show slightly different pictures. Cotality’s hedonic index shows Melbourne dwelling values up 4.8 per cent for 2025. Domain’s median house price data shows 7.4 per cent. The gap reflects methodology – Cotality includes units, which underperformed houses and pulled the combined figure down.

Both point in the same direction: signs of recovery, modest compared to other capitals, and confirmation that Melbourne’s value gap remains.

Wakelin’s enquiry data captures something these measures do not – directional shifts in investor sentiment and where serious capital is targeting, before it appears in transaction statistics.

KEY POINT

Wakelin’s data shows investor appetite returning to Melbourne through 2025 – led initially by interstate buyers, with early signs of Victorians following. Disposal enquiries falling suggests the exodus has passed. Whether momentum continues depends on whether confidence consolidates or wavers through 2026.

Where Does Melbourne’s Property Market Stand as We Enter 2026?

Jarrod McCabe

Director

We’ve been calling Melbourne undervalued for years. In 2025, increasing numbers of investors agreed.

The value gap with other capitals has only widened. While Brisbane, Perth and Adelaide delivered growth of 80 to 90 per cent over the past five years, Melbourne managed roughly 15 per cent.

Yet the fundamentals here remain intact: the strongest population growth by volume of any Australian city, constrained housing supply, high livability and employment opportunities, and relative affordability against Sydney has widened markedly.

The value is evident. What’s been missing is the confidence to act on it.

How did Melbourne property confidence start to build in 2025?

After a prolonged period of stagnation, a genuine shift in market psychology began to take hold through 2025. Interest rate expectations shifted, and buyers who had been waiting finally acted. Clearance rates lifted into seller’s-market territory. Interstate investors led the charge – buyers from Sydney, Brisbane and Perth who assessed Melbourne on fundamentals rather than sentiment and saw opportunity. That interstate capital flow appeared to spark renewed interest among local investors, with early signs of Victorians re-engaging by the second half of the year.

The Wakelin Melbourne Spring Property Report documented this shift in real time: enquiries lifting, clearance rates climbing, interstate capital flowing in.

Why did Melbourne’s property momentum stall in December 2025?

Rate speculation turned. Inflation came in stickier than expected, the Reserve Bank’s tone shifted hawkish, and by December – before any rate movement had occurred – clearance rates had already dropped and the market pulled up earlier than usual heading into summer. In February, the RBA raised rates for the first time since 2023, taking the cash rate to 3.85 per cent.

What does the shifting sentiment mean for Melbourne property investors in 2026?

Melbourne’s recovery now depends on whether rate uncertainty resolves quickly or persists. A single 25 basis point rise does not fundamentally alter the equation for most buyers. While it

slightly reduces borrowing capacity, the serviceability buffers (stress-testing at 3 per cent above

the actual rate) mean most active buyers are already qualified to handle this shift.

The real impact is psychological. What matters is not the extra repayment today, but the narrative it creates: is this a one-off recalibration, or the start of a new tightening cycle?

Uncertainty is harder to price than bad news. The 2022–23 rate cycle was damaging not just because rates rose, but because they rose steeply and repeatedly over an extended period. If 2026 resolves differently – one or two rises followed by stability – buyers can calibrate, and the conditions that drove the 2025 recovery remain in place.

Melbourne enters 2026 undervalued – and with confidence that was just beginning to rebuild now wavering again. Whether the value story can reassert itself depends on how the tension between structural strength and sentiment plays out.

That’s why this report is built around six questions that will shape Melbourne’s trajectory in 2026 and beyond:

- Will Melbourne property confidence consolidate or waver?

- How are Victorian policy and politics shaping investor sentiment?

- Rent vs buy in Melbourne: Will the math shift the market?

- Can Melbourne apartments finally narrow the gap on houses?

- Will new infrastructure shift Melbourne property demand?

- How are AI and socials reshaping Melbourne property discovery?

KEY

POINT

Melbourne’s value case is built on measurable gaps – 15 per cent growth over five years against 80 to 90 per cent in Brisbane, Perth and Adelaide – not sentiment. The February rate rise is the first real test of whether recovering confidence can hold. For investors, the calculus is whether to wait for certainty that may not arrive, or position ahead of a market that remains structurally underpriced.

Will Melbourne Property Confidence Consolidate or Waver in 2026?

Melbourne’s 2026 outlook comes down to a contest between two forces: structural value that has built over years of underperformance, and a confidence deficit that remains quick to retreat.

As Cotality’s Tim Lawless observed, Melbourne’s challenge is not affordability – it is confidence in the state’s economy and interest rates.

Confidence is the

constraint – and

confidence here is

rate-dependent

Why did Melbourne’s confidence stall before rates even moved?

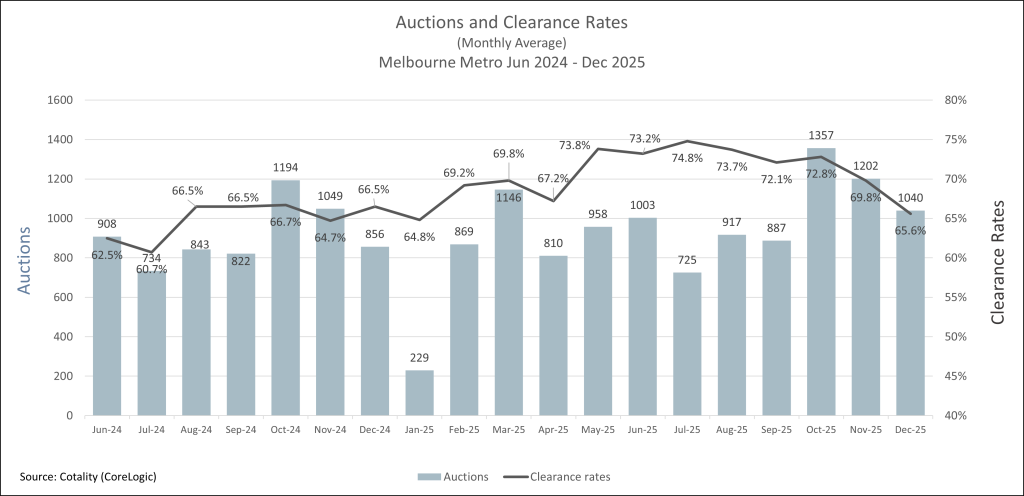

Through 2025, the conditions for recovery came together – rate expectations eased, clearance rates climbed into seller’s-market territory, and serious capital began to move, as the previous section detailed.

Then the mood shifted. Inflation data came in higher than expected. The Reserve Bank’s tone turned hawkish. Clearance rates fell from just over 72 per cent in October to 65.6 per cent by December.

Clearance rates fell to 65.6 per cent by December as rate expectations shifted.

No rate movement had occurred. The shift in expectation alone was enough.

This pattern – confidence building, then retreating on sentiment rather than substance – captures Melbourne’s particular vulnerability. Other capitals have built sustained price growth that reinforces buyer conviction. Melbourne’s recent gains had not yet reached that point when the headwind arrived.

What does the February 2026 rate rise mean for Melbourne property investors?

The February rate rise creates a pause, not a verdict – its real impact is psychological rather than financial. The RBA’s February decision – raising rates to 3.85 per cent – was unanimous across all nine board members. In its post-decision forecasts, the RBA projected trimmed mean inflation peaking at 3.7 per cent, up from 3.2 per cent in November, with a return to the target band not expected until early 2027.

Yet the tone was measured. Governor Michele Bullock noted she was not sure whether the bank was entering a “tightening cycle” – a signal that the RBA intends to let the data guide its next moves.

Why does rate uncertainty matter more than the rate itself for Melbourne property?

Because the 2022–23 rate cycle left psychological scars that make Melbourne buyers particularly sensitive to unclear signals. The 2022–23 rate cycle offers a cautionary memory. In late 2021, then-governor Philip Lowe indicated rates were very unlikely to rise before 2024. What followed was the steepest and fastest tightening cycle in the RBA’s modern history – 13 rises totalling 425 basis points between May 2022 and November 2023. Buyers who entered the market on one set of assumptions found themselves refinancing into a completely different reality.

That experience left marks. It helps explain why even the prospect of rising rates in late 2025 was enough to cool Melbourne’s market before any movement occurred.

But rate cycles are not all alike. The 2022–23 episode was exceptional in its speed and severity. Whether 2026 follows a similar path or a more moderate one remains to be seen.

Jarrod McCabe

Director

Wakelin Property Advisory

What we saw through 2025 was genuine: enquiries lifted, interstate capital arrived, and local investors started to re-engage. The conditions for recovery were there.

The February rate rise interrupts that momentum – but it doesn’t erase it. One rise, in isolation, changes very little for a buyer who was already stress-tested at rates well above today’s level. What it does is create a pause while people work out what comes next.

The 2022–23 cycle was severe – the sharpest rises on record, delivered after guidance that rates would stay low. That experience shaped expectations, and it’s natural for people to be cautious now. Whether this cycle follows a similar path is genuinely unclear. It may, or it may not.

What I’d say is this: even if confidence takes a broader hit, there will be a segment of investors who choose to push through. Those with strong equity positions, who understand Melbourne’s fundamentals and can absorb the short-term uncertainty, will continue to identify value. The structural case hasn’t changed – and for those positioned to act, dips in sentiment can be opportunity rather than obstacle.

KEY

POINT

Confidence – not fundamentals – is Melbourne’s constraint. The February rate rise is a test, but not a verdict. What matters is whether uncertainty persists or resolves. For investors with the capacity to look through short-term noise, Melbourne’s structural value remains intact.

How are Policy and Politics Shaping Melbourne Investor Sentiment?

Sentiment has been central to Melbourne’s confidence problem — and understanding where that legacy sits heading into 2026 matters for assessing the outlook.

What does Victoria’s property policy legacy mean for Melbourne investors in 2026?

The shocks that triggered Victoria’s investor exodus – land tax changes, rental regulation tightening, and the broader COVID shutdown hangover – have largely been absorbed in practice. Wakelin’s disposal enquiries dropped from 35 per cent to 23 per cent through 2025. New investors entering the market appear to have priced in current settings.

But sentiment takes longer to repair than spreadsheets. These changes left many feeling Victoria had become a difficult place to invest – and that perception lingers. The ‘Anywhere But Melbourne’ refrain captured a genuine disillusionment, and the confidence damage may help explain why Melbourne’s nascent recovery could be unsettled so quickly by rate-rise speculation. A market still carrying reputational baggage is more easily spooked.

Value of investor lending as a % of total lending (Sept 2025)

Source: Cotality, Monthly Housing Chart Pack – January 2026, ‘Investors lending – investors as a portion of total lending by state’ (Sep 2025)

What new and potential policy changes are impacting Melbourne investor sentiment?

While the major shocks appear absorbed, newer policy continues to reshape the landscape – some adding friction, others providing support.

What do Victoria’s reserve price disclosure rules mean for property buyers?

Victoria’s proposed reserve price disclosure rules were announced by the State Government in late 2025, and will require vendors to publish their reserve at least seven days before auction. The intent is buyer transparency. The practical effect introduces new complexity – vendors must set reserves before the critical final weekend of inspections, and there are concerns about cashed-up buyers using disclosed reserves to lock out competition through pre-auction offers.

Whether these unintended consequences materialise remains to be seen. But the broader point is straightforward: another policy change adding friction to Victorian property transactions. It doesn’t help Melbourne shake the perception of a state that keeps changing the rules.

Jordan Telfer

Property Advisor

Wakelin Property Advisory

“A property quoted at $1 million to $1.1 million, with a reserve disclosed at $1.1 million, can still sell for $1.35 million if two determined bidders see value above that figure. Knowing the reserve tells buyers little about what a property will actually sell for.

The bigger concern is unintended consequences. Once a reserve is publicly disclosed, it creates a clear target. A cashed-up buyer can lodge a pre-auction offer at or just above that figure – in an attempt to lock out others still completing their due diligence. The reform designed to protect buyers could inadvertently push more sales toward opaque processes.”

How is federal capital gains tax policy shaping the Melbourne investment outlook?

After more than two decades untouched, the capital gains tax discount is back on the table. A Senate inquiry and the government’s openness to broader tax reform have put a cut to the concession in play.

On a $500,000 gain, cutting the discount from 50 to 25 per cent would add roughly $60,000 in tax at the top marginal rate.

Whether any change eventuates – and what form it takes – remains uncertain. Any reform would likely come with lead time and transition provisions.

But the discount has been treated as a fixed setting in property investment since 1999; that assumption is now in question.

For investors, the focus is less on predicting a single reform and more on planning for a range of tax outcomes over the next decade. Well‑chosen assets in quality locations remain anchored by fundamentals, but portfolio, ownership and debt settings are stronger when they assume that federal tax – like interest rates – is a moving part, not a fixed backdrop.

Confidence is the

constraint – and

confidence here is

rate-dependent

How is the First Home Buyer Guarantee affecting Melbourne’s property market?

At the federal level, the expanded First Home Buyer Guarantee scheme is providing support in the opposite direction. The five per cent deposit threshold is pulling forward demand, particularly in the sub-$950,000 apartment/unit market.

There is an interesting intersection here. The properties exiting investors have vacated – smaller houses and apartments – overlap significantly with what first home buyers are targeting. Whether First Home Buyer Guarantee demand absorbs the slack left by investor exit will be worth watching through 2026.

How will the 2026 Victorian election shape property investment policy?

A Victorian state election is due to be held in 2026. Initial polling has suggested a more competitive contest than in recent years, with the opposition under revamped leadership, which may present a credible alternative. Contested elections tend to sharpen policy focus.

Both major parties’ positions on property investment – land tax settings, rental regulation, stamp duty reform – will shape investor sentiment heading into and beyond the election. A change of government would not automatically reverse existing policy, but could shift the trajectory. Investors would be wise to monitor the policy platforms as they emerge.

KEY

POINT

The policy shocks that drove investor flight appear to have been absorbed in practice, but the confidence damage lingers – leaving Melbourne more vulnerable to sentiment shifts. New policy continues to add friction, though federal first home buyer support provides some offset at the entry level. The 2026 state election introduces another variable worth monitoring.

Rent vs Buy in Melbourne: Will the Math Shift the Market in 2026?

Melbourne’s rental market has stabilised at high levels rather than eased in any meaningful way. For investors, that supports yields. For renters, it keeps the appeal of ownership very much alive.

In a city that remains relatively affordable compared with Sydney, the expanded First Home Buyer Guarantee – with its five per cent deposit threshold – may enable a subset of renters to make the jump into ownership in 2026, particularly in the apartment market.

Where are Melbourne rents heading in 2026?

Cotality data shows Melbourne recorded the softest rental growth of any Australian capital in 2025, with rents rising about 2.9 per cent over the year, compared with stronger increases elsewhere. Vacancy rates remain low, sitting around the low‑2 per cent range, so conditions are tight even if growth has eased.

The picture varies sharply by property type. PropTrack reports that Melbourne was the only capital where house rents fell year‑on‑year in December 2025, down 0.9 per cent, while unit rents rose 4.5 per cent over the same period. That split reflects location dynamics: many outer‑suburban house markets are facing softer demand and greater interchangeability, while well‑located apartments in inner‑city and inner‑fringe suburbs remain tightly held and strongly contested by renters.

Source: Cotality

What do Melbourne rental trends mean for investment yields?

For investors, slower rental growth is offset by slower price growth in Melbourne. That has helped yields hold relatively steady compared with markets like Sydney, where prices have run ahead of rents. Cotality estimates Melbourne’s gross rental yield at around 3.6 per cent, versus roughly three per cent in Sydney. That relative value supports the investment case for Melbourne more than some other capitals.

Will Melbourne rental pressure convert to buying demand in 2026?

The federal government’s expanded First Home Buyer Guarantee has changed the arithmetic for many renters. A five per cent deposit on a $750,000 property is $37,500, compared with $150,000 at a traditional 20 per cent deposit. For renters who have been saving while paying high rents, this materially lowers the barrier to entry – particularly for sub-$950,000 apartments.

REA Group senior economist Anne Flaherty notes that renters in Melbourne are more able to transition into home ownership than those in Sydney because Melbourne is relatively more affordable, and that every time a renter buys a home it typically frees up a rental property for someone else.

The federal government’s expanded First Home Buyer Guarantee has changed the arithmetic for many renters. A five per cent deposit on a $750,000 property is $37,500, compared with $150,000 at a traditional 20 per cent deposit. For renters who have been saving while paying high rents, this materially lowers the barrier to entry – particularly for sub-$950,000 apartments.

REA Group senior economist Anne Flaherty notes that renters in Melbourne are more able to transition into home ownership than those in Sydney because Melbourne is relatively more affordable, and that every time a renter buys a home it typically frees up a rental property for someone else.

Jordan Telfer

Property Advisor

Wakelin Property Advisory

“Rents in Melbourne aren’t peeling away – at best they’re stabilising, and in quality inner-suburban locations we’re still seeing strong competition. At a recent mid-week inspection in Brunswick, we counted 27 people waiting for the property manager. That kind of pressure can only run so far before some renters decide they’re better off owning if they can.

For those able to use the five per cent deposit scheme, particularly in the sub-$950,000 apartment market, we expect some of that rental demand to convert into buying in 2026. Build-to-rent is becoming more popular too and should, over time, add professionally managed stock and ease pressure in the tightest segments – but it’s a medium- to longer-term influence rather than something that will noticeably shift rental conditions in the next 12 months.”

KEY

POINT

Melbourne’s rental market is stabilising rather than easing, with inner-city units still seeing growth while some outer-area houses soften. The five per cent deposit scheme may help a subset of renters – especially those targeting sub-$950,000 apartments – become buyers in 2026, but this will be a selective trickle rather than a flood.

Can Melbourne’s Apartment Market Finally Catch Up?

Melbourne’s apartment market is unlikely to move as a single, uniform category. The strongest prospects sit in older, well-located, low-rise blocks where notional land value, rising unit rents and constrained new supply are aligning. Performance will remain selective – and sensitive to interest rates and confidence.

Where does Melbourne’s apartment market stand now?

Through the COVID period, detached houses decisively outpaced apartments as buyers prioritised space. Over the past year, that gap has begun to narrow. Nationally, house and apartment price growth are now running broadly level rather than houses clearly leading. That convergence suggests the structural underperformance of apartments may be ending – and Melbourne, where apartments have lagged most, stands to benefit if the pattern holds.

Source: Cotality

The rental side reinforces this. Melbourne unit rents rose 4.5 per cent over the year while house rents fell 0.9 per cent – reflecting persistent demand for well-located apartments even as some outer-suburban house markets soften.

Why does notional land value matter for Melbourne apartment investment?

This is not a blanket positive view on all apartments. As articulated in Wakelin’s article in the Australian Financial Review, the growth story is a land story, not a tower-amenity story. There is a stark difference between older, low-rise apartments in small blocks on generous land, and high-rise towers in oversupplied precincts. The former are the focus here; the latter may continue to underperform.

What is notional land value?

Your proportional share of the land the building sits on. In a six-unit block on a 600sqm site, each apartment’s notional land value is roughly 100sqm of that land – often the most valuable component of the purchase, and the primary driver of long-term capital growth.

In many low-rise blocks built between the 1940s and 1970s in strong inner and middle-ring suburbs, that land component is substantial and often under-recognised. Today, with vacant and / or developable land increasingly scarce and construction costs materially higher, many of these apartments trade below replacement cost.

Developers paying premiums for under-capitalised blocks in investment-grade suburbs signals this mismatch. When a basic four-pack on a large site sells to a developer for well above the sum of its individual apartment values, the market is repricing the land.

What does investment-grade apartment stock look like in Melbourne?

The apartments with strongest long-term growth potential tend to share specific characteristics:

- Low-rise buildings of two to four storeys

- Built mid-20th century (1940s–1970s)

- Larger land parcels with relatively few units

- Established, high-demand suburbs with strong owner-occupier base

- High proportion of purchase price attributable to land

- Quiet, well located, residential streets

These are the segments Wakelin Property Advisory focuses on when advising buyers considering apartments.

Who will drive Melbourne apartment demand in 2026?

Several buyer cohorts are converging on this same slice of the market:

- First home buyers – constrained by the $950,000 price cap and priced out of houses in their preferred locations, older apartments on good land offer an accessible path into suburbs they actually want to live in

- Investors – seeking yield with land backing in a market where house entry points have moved beyond reach for many; sub-$1 million apartments in established suburbs offer attractive returns tied to land scarcity rather than building amenity

- Downsizers – trading floor space for location and lower maintenance without sacrificing long-term capital growth potential

This demand meets a supply side that is shifting. Investor sell-downs have eased – Wakelin’s disposal enquiries dropped from 35 per cent to 23 per cent through 2025. Limited new mid-market apartment supply is coming through in the right locations. The balance in this segment is subtly shifting.

Jordan Telfer

Property Advisor

Wakelin Property Advisory

“For the past couple of years, Melbourne’s apartment market has been in relative equilibrium. Investor exits were meeting demand and absorbing pressure, while construction costs and planning hurdles meant very little affordable, investment-grade stock was being added in the right locations.

That’s starting to shift. The exits have slowed and demand is broadening – first home buyers using the five per cent scheme and investors all looking at similar price points in established suburbs. We’re not expecting a boom across all units, but for older, low-rise apartments on good land, the ingredients are there for a more meaningful catch-up – particularly if rates hold and confidence improves.”

KEY

POINT

Melbourne’s apartment opportunity is selective, not universal. The most compelling prospects lie in older, low-rise apartments on scarce, well-located land – where rising unit rents, constrained new supply and under-recognised notional land value support a medium-term catch-up. Generic high-rise stock will likely continue to lag.

Will New Infrastructure Shift Melbourne Property Demand?

Infrastructure will not move Melbourne’s overall market as much as interest rates in 2026, but it will continue reshaping where within the city demand concentrates. New transport links lay the groundwork for long-term shifts in accessibility and desirability – not immediate price movements.

How does infrastructure affect Melbourne property values?

Infrastructure influences values by reducing travel times, improving reliability and lifting local amenity. Over time, that changes the mix of households who choose a suburb – and those demographic shifts gradually filter through into rents and prices.

A new rail link opened in 2025 does not single-handedly move prices that year. Its real impact plays out over five to ten years as commuting patterns, school choices and retail footprints adjust. Infrastructure is best viewed as a long-term amplifier of underlying fundamentals – helping good locations become more convenient, and helping ‘next ring out’ areas plug into the economic core.

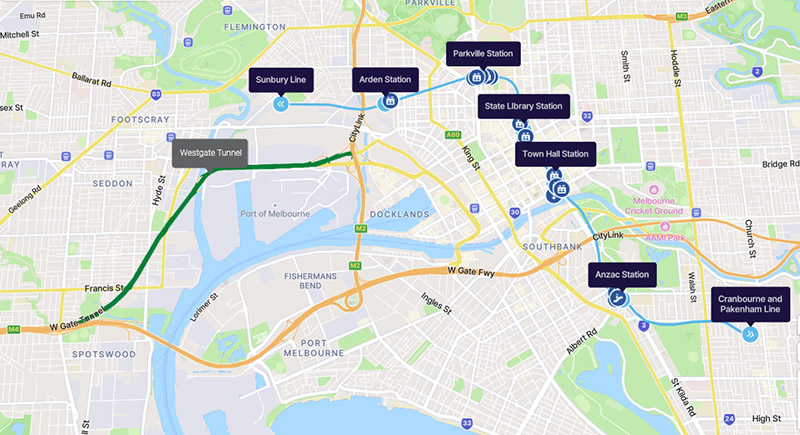

What do the Metro Tunnel and West Gate Tunnel mean for Melbourne?

Two major projects reached

completion in late 2025:

the Metro Tunnel and

the West Gate Tunnel.

The Metro Tunnel creates new underground stations at Arden, Parkville, State Library, Town Hall and Anzac, running new rail lines through the CBD. For suburbs like Footscray, Seddon and Yarraville, this is significant. Footscray to Parkville – home to major hospital and university precincts – now takes approximately eight minutes by train.

Previously, that journey required tram changes or driving. For young professionals priced out of Parkville, Carlton and North Melbourne, the inner west becomes a more viable alternative.

The West Gate Tunnel removes trucks from residential precincts around – Francis Street, Somerville Road and surrounding areas become 24/7 truck-free zones. Reduced heavy vehicle traffic, improved air quality and better travel times to the CBD reinforce trends already underway in Footscray, Seddon, Yarraville and Spotswood.

Neither project transforms Melbourne’s property market overnight. But both deepen the pool of buyers and renters who see these suburbs as genuinely accessible to employment, education and amenity.

Brenton Potter

Manager, Property Advisory

Wakelin Property Advisory

“The Metro Tunnel is a big tick for the inner west. Someone can get on a train at Footscray and be at Parkville Station within eight minutes – before that they would have had to catch a tram or change trams. Young medical professionals priced out of Parkville, Carlton and North Melbourne might now look west and say, ‘I’m only an eight-minute commute and I can leave my car at home.’ That’s a genuine selling point.

For investors, infrastructure is one layer in the decision. It can make good locations better and help some areas close the gap over time, but it doesn’t fix poor fundamentals. We still anchor our view on underlying land quality, scarcity, demographics and existing amenity.”

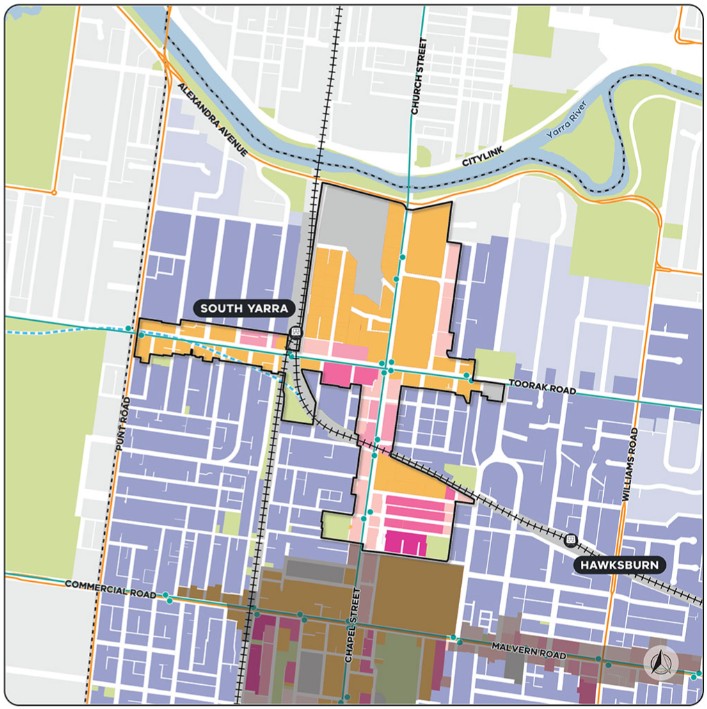

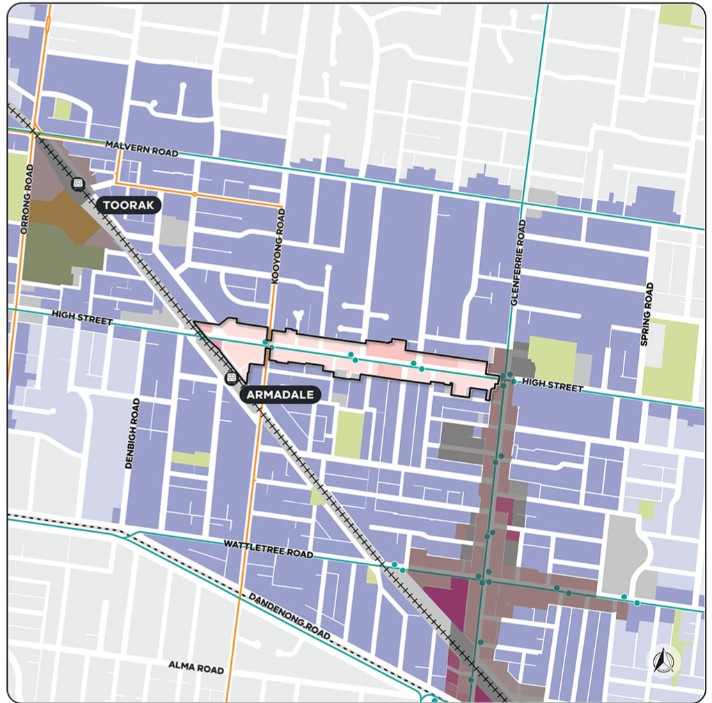

How will Victoria’s activity centre planning reshape Melbourne housing supply?

A separate but related shift is underway in planning policy. The Victorian government’s Activity Centres Program aims to deliver more housing around train and tram-served centres across Melbourne. Draft guidance shows substantial height envisaged in some centres, including parts of Kew Junction, Hawthorn, Elsternwick and Brighton.

Some of these changes could benefit areas by adding mixed-use development, public realm improvements and better amenity around transport hubs. Others have sparked concern — particularly in premium suburbs like Brighton and Camberwell, where residents worry that high-density development could shift the character of established neighbourhoods.

It is too early to know exactly how each activity centre will evolve. Much depends on design quality, staging and how planning controls are ultimately applied. This is one to watch through 2026 and beyond.

Map of South Yarra Activity Centre

Images Victorian Government

Map of South Yarra Activity Centre

Images Victorian Government

KEY

POINT

Infrastructure will not transform Melbourne’s market in 2026, but it will gradually reshape its internal map. The Metro Tunnel and West Gate Tunnel reinforce the inner west’s accessibility, while activity-centre planning will selectively increase density around transport hubs.

How Are AI and Socials Reshaping Melbourne Property Discovery?

The way property is discovered, marketed and transacted is shifting — and the pace is accelerating. Social media is emerging as a genuine sales channel for certain segments, while AI is starting to reshape how buyers find and research property. Neither will transform the market in 2026, but both signal longer-term structural change that investors should be watching.

Is social media becoming a real sales channel for Melbourne property?

Melbourne agent Luke Saville sold 40 per cent of his apartment listings directly through Instagram in 2025. That is not a marketing gimmick. It is a sales channel.

What Saville and a handful of others have demonstrated is that trust can be built through content and personality rather than listing platforms.

A consistent social media presence, targeted at a specific buyer demographic, can generate enquiry, build relationships and close sales – and sidestep traditional portal advertising.

For vendors selling to younger buyers in inner-city apartment markets, this raises a genuine question: is a social-first approach better suited to reaching your buyer than a premium listing on a major portal? The cost savings can be significant – tens of thousands in advertising fees redirected or avoided entirely.

For agents, the implication is clearer still. Early movers are building personal brands in specific niches. As more agents recognise the opportunity, this model will expand – not replacing traditional channels, but sitting alongside them as a legitimate path to market.

This is not a passing generational novelty. The cohort comfortable buying through social media today are likely to carry those habits forward.

Brenton Potter

Manager, Property Advisory

Wakelin Property Advisory

“For that apartment sector, social media has become a genuinely powerful avenue. You’re targeting the right buyers very directly, and it can build a surprising amount of trust and rapport before anyone ever walks through the door.”

Could AI disrupt how Melbourne property investors find opportunities?

REA Group’s shares lost almost $9 billion, or 25 per cent late last year on concerns that AI could let buyers bypass property portals entirely. Share markets price forward – that correction reflects genuine uncertainty about the portal model’s long-term dominance.

Portals operate on a pay-for-prominence model: vendors and agents pay to have listings seen. AI search, as it matures, could surface the best-fit property regardless of advertising spend – matching buyer criteria against available stock without favouring paid placements.

For investors, this may shift the game. In some instances, AI tools can already provide richer context than a listing page: sales history, demographic trends, suburb comparisons, yield calculations. The investor who masters these tools and navigates the risks and unknowns inherent in any new technology gains an edge over those who wait passively for listings to appear.

The explosion of online data and research tools over the past decade has already favoured those who take the time to dig. AI is likely to accelerate that trend.

KEY

POINT

The way property is discovered and sold is changing. Social media is emerging as a legitimate sales channel, particularly for inner-city apartments targeting younger buyers. AI is starting to reshape property search by bypassing pay-for-prominence models and rewarding active research. For investors, the implication is clear: the information advantage increasingly goes to those who seek it – or engage advisors who do.

Jarrod’s Take Home Advice: Shaping Investment Decisions From Here

Markets stall for different reasons. Sometimes the fundamentals are broken – oversupply, weak demand, deteriorating economics. Sometimes the fundamentals are sound but sentiment isn’t. They look similar in the short term. They resolve very differently.

Melbourne right now is a sentiment problem. The data in this report makes that clear. Population growth, supply constraints, the price gap with other capitals – none of that has deteriorated. What’s changed is confidence, and confidence is harder to measure and harder to predict.

The February rate rise complicates the picture. Not because one quarter-point move materially changes investment returns – it doesn’t – but because it reopens the uncertainty that had started to settle. For a market as rate-sensitive as Melbourne has proven to be, that matters.

Each year I offer a prediction. This year requires a range. If the rate path clarifies quickly – one or two adjustments and done – I expect Melbourne to deliver growth in the 4-7 per cent range as deferred demand returns. If uncertainty persists, we’re looking at something flatter, perhaps in the 1-4 per cent range, with the structural undervaluation taking longer to correct.

What I’d observe from three decades in this market: the investors who built substantial portfolios weren’t the ones who timed sentiment perfectly. They were the ones who understood value, knew their own holding capacity, and didn’t need the market to give them permission. That profile of investor is active right now. Whether the broader market follows in 2026 depends on questions none of us can answer yet.

Download for free now

Your Details

Download the report here