By Jarrod McCabe, Director of Wakelin Property Advisory

Published August 2025

Read a preview of the report below or download the full version

Download for free now

Your Details

Melbourne Property Market

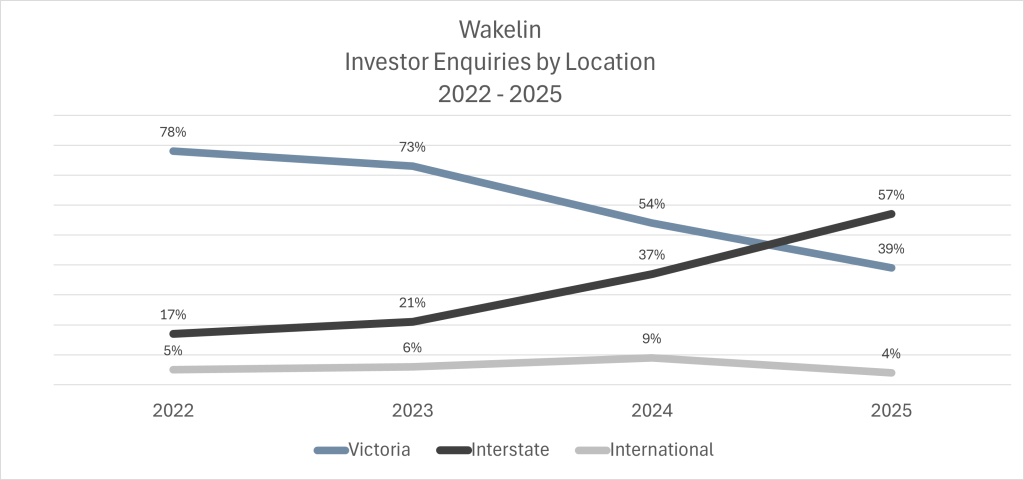

New data from Wakelin Property Advisory points to a significant shift underway in Melbourne’s investment market.

Interstate investors now make up 57% of total investor enquiries, around triple their 17% share in 2022.

Victoria’s share has dropped by half from 78% to 39% in the same period.

This marks the first time in my career that investor buyer demand in Melbourne has been led by interest from outside the state.

Many local investors remain on the sidelines, wary after years of tepid growth, rising taxes, and stringent new rental regulations.

In contrast, interstate buyers see opportunity amid these challenges and are leading Melbourne’s property investment recovery.

Why interstate investors are moving first – and what it signals

Buyers from Brisbane, Perth and Adelaide, and to a lesser extent Sydney have enjoyed strong capital gains since COVID-19, with growth rates of 70% or more in some markets according to data from Cotality.

The data suggests many of those investors are looking to gain exposure outside of their home markets, which may be plateauing and redeploying capital into an undervalued Melbourne market, with strong long-term potential.

Melbourne has lagged in recent years. Local policy settings – including a lower land tax threshold and rising rental compliance costs – have weighed on investor sentiment. While COVID-19 saw many Victorians sell down and exit the market entirely.

Interstate investors may be less encumbered by this baggage, and can more objectively see a city with strong fundamentals, a historically consistent growth trajectory, and clear signs of value relative to other capitals.

Download the full report for access to the complete findings and to understand their implications for Melbourne’s Spring market.

Download now

Your Details

What Victorians see as a tax burden, interstaters treat as a trade-off

Many locals – facing rising taxes – have slowly seen their real-term profits eroded over several years, leading to deepening disengagement.

Interstate investors, by contrast, are arriving with clearer eyes – less encumbered by past policy fatigue and more able to assess Melbourne’s fundamentals objectively.

They’re willing to absorb Victoria’s higher taxes in order to secure a position in a market they see as undervalued and primed for recovery.

Many have already experienced strong capital growth in their home states – and are now pursuing further hidden value beyond their borders.

For them, the taxes are simply one variable – part of a broader equation weighed against the opportunity to lock in long-term capital gains before Melbourne’s next growth cycle takes hold.

Download the full report for access to the complete findings and to understand their implications for Melbourne’s Spring market.

Download now

Your Details