As we approach the close of 2024, it’s the perfect time to reflect on the property market’s performance and consider the trends, issues, and driving forces that have shaped it – and how they may continue to influence the market as we move into 2025.

To delve deeper into 2024 and beyond I was joined in conversation with my colleagues – Property Advisor, Jordan Telfer and Brenton Potter, Manager, Property Advisory.

Reflections on 2024

Taxes and rents increased, interest rates remained flat: Jarrod

This year, the property market has been shaped by several key factors. Interest rates stabilised after a period of significant increases over a relatively short timeframe.

Investor sentiment shifted due to changes in legislation. These included stricter expectations for maintaining properties and adjustments to land tax, which became a major influence on market activity.

The rental market continued to build, with vacancy rates remaining tight. This added pressure on leasing and highlighted ongoing demand in the rental sector.

Looking back, land tax stands out as one of the biggest influences on the market this year.

A lackluster market: Jordan

This year’s market has been, in a word, lackluster. It’s neither one thing nor the other, and that’s reflected in median values, which have been reported as dropping slightly. Yes, they’ve fallen, but not significantly – not in the way you’d typically see in a normal downturn.

It’s a far cry from 2018, when a clear downturn followed years of growth. Back then, you could feel it at auctions – buyers turning up to take advantage of stressed vendors, then walking away to the next property if their price wasn’t met.

This year, there are still good properties selling for good prices, but the overall market lacks that same dynamic. This spring, we saw a market that never really kicked on. Numbers have been lower this year, but the quality has been even lower again. That’s likely a reflection of the type of properties coming to market, whether houses or apartments. A significant driver of this trend seems to be investors looking to exit the market.

A new interest rate norm for buyers: Brenton

Interest rates and the cash rate have remained stable for 12 months, with the last change in November 2023.

This stability has become the new norm, and buyers are adjusting their expectations, realising that a significant reduction in interest rates from the RBA isn’t likely anytime soon.

That said, this steadiness has given buyers a bit more confidence moving forward. They now have a clearer idea of what they can borrow, knowing those numbers aren’t likely to change significantly in the near future.

While a rate reduction could happen early next year, for now, buyers are operating under the expectation that rates will remain steady.

Analysing sales data

A Shift Toward Selling: Jarrod

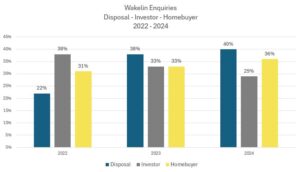

This year, one of the standout trends we’ve noticed as a business has been the increase in enquiries from sellers. While we track inquiries across various categories – home buyers, investors, and disposals (sales) – it’s the disposals that have shown a clear and significant rise over the past 12 to 18 months.

In 2022, disposals accounted for 22% of our enquiries. By 2023, that figure had climbed to 38%, and this year, it has reached 40%. This sharp increase highlights a growing interest in selling property rather than buying, shifting the balance in supply and demand.

This change reflects a clear shift in mindset, with many sellers taking a more active role in the market, perhaps driven by financial pressures and regulatory changes. Understanding these factors will be crucial to navigating the market moving forward.

Key drivers behind increased selling activity: Jordan

Interest rates have reached a point where they’re genuinely starting to hurt. While rents have increased significantly over the past 12 to 18 months, higher mortgage repayments are eating up those gains, leaving many investors under pressure.

Increased regulatory and tax burdens, such as changes to the Residential Tenancies Act and reductions in land tax thresholds have added significant costs for property owners. Many are feeling the financial strain, particularly those who now face unexpected land tax bills.

The stagnation in capital growth, especially apartments, has been a major factor. With minimal growth in even high-quality stock, the incentive for investors to hold onto their properties is diminishing.

Together, these factors are pushing many investors to reconsider their positions and exit the market.

Trends are set to continue: Brenton

It’s likely these trends will continue. Even without major changes in interest rates – whether up or down – the overall market sentiment may not shift dramatically.

While buyers might see some renewed confidence over time, the new taxes and regulatory changes are here to stay and will continue to have an impact.

As Jordan pointed out, these changes are a rude shock for many investors and will likely have a lasting effect on their decisions moving forward.

A slight kick in early 2025: Jordan

The first few months of the year are traditionally a good time to sell property, especially for those needing to act within the calendar year. There’s often an imbalance between supply and demand that favors sellers, as buyers re-enter the market after the holiday season with renewed enthusiasm. This period is typically marked by a sense of confidence, with buyers looking to make a fresh start, whether it’s upgrading their own home or making an investment.

For Melbourne, this early-year momentum could provide a much-needed spark. While affordability might improve slightly if interest rates decrease, the real boost is likely to come from a shift in buyer confidence.

Is Melbourne undervalued?: Jarrod

Given the increase in supply, reduction in demand, and slowing prices, Melbourne continues to stand out as good value compared to other cities. This trend could become even more pronounced next year.

It may take an interest rate cut to shift investor sentiment significantly. Lower rates would improve borrowing costs, and with values steady and rents rising, yields would look increasingly attractive. At some point, investors are likely to see the market as too good to pass up, even with added costs like land tax.

However, it’s unlikely that 2025 will be the true turning point. While this shift will happen, it’s more likely further down the track.

Interstate investors eyeing Victoria: Jordan

I’ve noticed increased interest from interstate buyers, particularly from Sydney, as media reports highlight Melbourne’s relative affordability compared to other cities. This perception of value is attracting attention from those seeking more cost-effective property options.

Interstate Investors to Provide Buoyancy to the Market: Jarrod

Investor loan rates are rising nationwide, but Victoria’s activity remains lower compared to other states. However, interstate investors, particularly those without existing holdings in Victoria, are starting to take notice.

For these buyers, Melbourne’s affordability and value proposition outweigh the added cost of land tax, which they can factor in upfront. Unlike existing investors blindsided by unexpected charges, these interstate entrants see opportunity in a market that others may be exiting.

This dynamic could bring a fresh wave of interest to Victoria’s property market.

Analysing purchasing data – Investors

Is a turnaround on the horizon?: Jarrod

On the buying side, the slowdown in investment activity has been striking. In 2022, investment-related enquiries made up 38% of our total enquiries. By 2023, this dropped to 33%, and this year, it has fallen below 30%, sitting at just 29%. The decline in investor interest has been steady and persistent.

At some point, for the reasons we’ve discussed – Melbourne’s value proposition, rising yields, and potential interest rate changes – you’d expect this trend to reverse. The question is, when? Could we see a tipping point next year, or is a turnaround likely further down the track?

The answer isn’t clear yet, but the current trends suggest a longer-term recovery. For now, investor activity remains muted, with conditions needing a notable shift before confidence returns in full force.

The need for investors in a tight rental market: Brenton

If vacancy rates remain at all-time lows and rents continue to rise, it highlights the pressing need for investors in the market.

Investors play a critical role in providing the rental supply needed to meet growing demand.

Without them, the strain on the rental market could intensify further, exacerbating affordability and availability issues for tenants.

Decline of investor influence in the apartment market: Jordan

Investors haven’t been a significant influence in the property market since the Royal Commission in 2017. That marked a turning point, with their presence gradually peeling away, particularly in the apartment market.

Previously, competitive tension between first-home buyers, investors, and downsizers kept the apartment sector dynamic. This demand helped maintain, or even slightly increase, the value of good-quality apartments – properties with desirable attributes and locations.

In contrast, investor-grade stock – high-rises and new developments aimed primarily at investors – has seen the steepest decline in demand and value. Without the competitive push investors once brought, this sector has struggled significantly.

For the apartment market to thrive again, that competitive tension needs to return. A mix of buyers and investors is essential to reinvigorate activity and drive growth in this space.

Analysing purchasing data – Homebuyers

Home Buyers, a steady force in the market: Jarrod

The home buyer sector has remained remarkably consistent over the past three years, consistently accounting for around 30-35% of inquiries. This stability reflects the fundamental demand for housing, driven by the universal need for homes.

While the market saw a surge in upgraders during the pandemic, this has since tapered off. First-home buyers, who temporarily stepped back during that period to consolidate their finances, are now more active. Their re-emergence is supported by opportunities created by investors exiting the market, offering good properties at attractive prices.

This steady activity highlights the enduring strength of the home buyer segment, which continues to play a vital role in maintaining balance in the property market.

Lifestyle over numbers – The home buyer mindset: Brenton

Home buyers are less focused on short-term capital growth or market numbers. For many, purchasing a home is more about lifestyle decisions than financial metrics.

They’re often prioritising the right property for their needs – whether it’s being in a particular school zone, finding a home with a swimming pool, or locating in a specific suburb. These buyers are less concerned about rental yields or long-term growth if they’re planning to live in the property.

For upgraders especially, the mindset is long-term. Many plan to stay in their new home for eight to ten years, making it less about immediate market conditions and more about finding a place that fits their lifestyle and future plans.

Key factors shaping 2025 and beyond

The emergence of build-to-rent: Jordan

The build-to-rent sector appears to be gaining momentum, with a significant pipeline of projects expected to come to fruition in the near term. This sector is likely to outpace the supply of traditional built-to-sell apartments, making it an area to watch over the next few years.

However, the nature of these properties is worth noting. Most build-to-rent developments focus on premium rental products, with two-bedroom apartments priced around $750 to $800 per week. These offerings cater to a specific demographic but may not address broader market needs for affordable rental housing. Not everyone can afford – or even wants – the communal spaces, gyms, and other amenities that often come with these developments.

This shift raises questions about how the build-to-rent model will impact the traditional rental market. As investors exit the established property market, their properties are often being absorbed by home buyers, leaving a gap in supply for standard rental properties. Inner suburban houses, for example, don’t naturally translate to the build-to-rent model, which means some segments of renters may struggle to find options that suit their preferences and budgets.

Potential for older-style apartments: Brenton

Older-style apartments have seen lackluster growth in recent years, but 2025 might bring a shift. Positioned in the right blocks and desirable locations, these properties still hold a place in the market.

Interest could be driven by young first-home buyers, particularly those seeking proximity to family homes in areas like Camberwell or Hawthorn. With parents nearby and the appeal of established neighborhoods, this segment of the market may find value in older apartments, creating an uptick in activity.

It will be interesting to see how these apartments perform next year – both in terms of growth potential and buyer interest. For the right properties, there’s an opportunity for renewed interest and value in 2025.

Stay informed with Wakelin’s 2025 Property Report

These are just some of the key factors poised to shape Melbourne’s property investment landscape in 2025. As the market continues to evolve, staying ahead of the trends will be essential for making confident and informed decisions.

Wakelin’s 2025 Property Report will provide expert analysis and actionable insights to guide your investments and identify emerging opportunities.

Sign up for our newsletter today and equip yourself with the knowledge to navigate the year ahead with clarity and confidence.

Listen to the podcast: