There are strong signals that the property market is moving into recovery mode, and a lot sooner than many people were anticipating at the start of the year.

CoreLogic’s national Home Value Index (HVI) increased by half a percent in April, following a 0.6% lift in March to be 1.0% higher over the past three months, indicating that the housing market has moved through an inflection point after the sharp declines of 2022.

Melbourne’s recovery greenshoots

In Melbourne, prices in some of the city’s more expensive suburbs have been rising. Historically, a lift in affluent areas signals a broader market shift is afoot.

According to Domain’s latest House Price Report, the inner-suburb of Alphington saw the biggest rise over the year to March, climbing 23 per cent to a median $1,975,0000.

The bayside suburb of Elwood was next, increasing 14.5 per cent to $2,625,000, while Albert Park was up 8.2 per cent to $2.5 million, and Kew, up 7.9 per cent to $2,752,000.

The data comes after the Reserve Bank of Australia (RBA) provided borrowers with some much needed reprieve in April, having pressed pause on record successive interest rate rises.

While further interest rate increases are anticipated, there’s light at the end of the tunnel, which serves to reduce uncertainty and bolster investor confidence.

Understanding the recovery

So what’s driving the recovery going forward? And how should investors approach the period ahead?

First, it’s important to look at the issue from a historical perspective and understand how market cycles within property work. Property market cycles tend to differ from those of the share market, which tend to be more unpredictable and erratic. Whereas property market movements are typically more stable and consistent.

When we compare the present day with property market recovery transitions in the past, we can start to recognise familiar patterns. For instance, in the period before the 2008 global financial crisis (GFC), the RBA implemented a series of rate rises, peaking at 7.25 per cent, as it tried to bring down the strong inflation at the time.

From mid-2007 to early 2009, as the global economic tumult mounted and local rate rises took effect national property values fell more than seven per cent over 13 months from peak to trough, which is not dissimilar to the drop we saw in Melbourne last year, where values fell more than eight per cent.

However, back then the RBA subsequently dropped rates quickly in the aftermath of the GFC to contain the fall out. And by March 2009 the national property market was back in positive territory, before going on to surge 12 per cent to December 2009.

We’re facing differing economic circumstances today, so are unlikely to see rates drop and prices surge as sharply as they did in 2009. This time around the market recovery is expected to be slower and steadier.

Regardless, the stabilising interest rates will certainly provide some welcome calm to what has been a volatile property market over the past year, providing a significant confidence boost for investors going forward.

The return of the investor

Investors haven’t been a strong presence within the property market over recent years.

They largely held off during the pandemic years, with the economic uncertainty pushing them towards consolidation, as opposed to purchasing. The often frenzied market activity over that period tended to be dominated by cashed up homebuyers, who were looking to upgrade homes and take advantage of savings – particularly as they were locked down with their typical spending avenues restricted.

Additionally, prior to the pandemic, the Royal Commission into the Banking Sector limited the borrowing capacity of many investors, curtailing their investment options and presence within the market.

However, the market dynamics moving forward are likely to be particularly enticing to investors, who have until now been waiting in the wings.

During our recent webinar, Stuart Wemyss from ProSolution Private Clients, suggested we would start to see greater flexibility around borrowing, which will certainly provide a boost to investors. We’ve seen some easing around lending restrictions in New Zealand, foreshadowing that Australia may follow suit – especially as it was Australia that followed New Zealand’s lead in tightening lending restrictions in the first place.

Melbourne’s surging rental market

As well as stabilising interest rates, investor confidence will be further enhanced by Melbourne’s tight rental market. Vacancy rates are currently sitting at around the one per cent mark, which is extremely low. While that’s not good news for renters, it underpins strong rental returns for investors.

Melbourne’s growing population – which depending on how you measure it – has already or is soon to overtake Sydney as Australia’s largest city. That’s going to drive greater demand for accommodation, both from a tenancy and home purchasing point of view, which will lead to continued pressure on rents, enticing greater numbers of investors back into the marketplace.

This is being compounded by the diminishing pipeline of new properties coming onto the market due to construction difficulties caused by the pandemic. That’s creating a lag effect, which means it’s going to take considerable time for supply levels to rebuild.

The rental shortage is also being exacerbated by longer term rental homes returning to the shorter term holiday/AirBnB market, now that tourism is recovering following the pandemic.

We’re also seeing the pandemic induced trend towards regional living reversing, with many gravitating back to the city, putting further pressure on supply levels and prices.

Additionally, many who were forced to live in shared accommodation either with family or friends during the economic uncertainty of the pandemic, are now eager to live in single dwellings.

The surging rental market, driven by these culminating factors, makes the property market a very attractive proposition for investors looking for strong yield, whilst accumulating capital growth going forward.

Capital growth rates

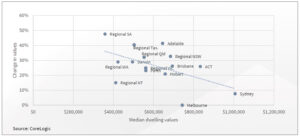

The graph below details another important factor at play. The strong capital growth seen in COVID-19, followed by the sharp drops last year, actually means Melbourne’s median house price growth is sitting at practically zero since the start of the pandemic.

When we compare this to other Australian cities, Sydney recorded close to a 10 per cent net rise in values for the same period, while Adelaide, Brisbane, Hobart, Perth are anywhere from 20 up 40 per cent up on their pre-pandemic median values.

While it’s unlikely any of those cities will move backwards significantly, it does mean Melbourne presents as good value comparatively.

Given Melbourne’s strong population growth, its pivotal position within the economy and recognition as one of the world’s most livable cities, there’s undeniably a large amount of upside potential in the months and years ahead.

Take home message

While the major thrust of the property market recovery may be six to 12 months away, the green shoots are definitely apparent. And while moving early, before the market has reached full swing can seem daunting, those that proceed sooner rather than later are likely to reap the rewards.