The Wakelin Property Report 2025

Melbourne Property Market Undervalued and Poised for Opportunity

by Wakelin Property Advisory

Published February 2025

Read a preview of the report below or download the full version

Download for free now

Your Details

INTRODUCTION

Melbourne’s Turning Point: Positioning for the next growth cycle

Melbourne’s property market is at a turning point, edging closer to its next growth phase after years of stagnation and unfavourable investment conditions that have kept prices subdued.

While many investors have chosen to exit – pressured by elevated interest rates, new taxes, and shifting regulations – this has created an opening for those ready to act.

With fewer buyers in the market, competition has eased, presenting opportunities to secure quality assets at good value.

Melbourne’s fundamentals remain strong, underpinned by the city’s population growth, infrastructure pipeline and liveability. The key is cutting through the noise to identify where the real opportunities lie.

With interest rates on their way down, confidence will gradually return, but don’t expect an immediate surge in prices. Instead, 2025 is likely to be a transitional year, where strategic investors position themselves ahead of the next sustained growth cycle.

While prices are expected to move within a -2% to +2% range over the course of the year, this period of stability will likely set the stage for stronger growth in the years ahead.

As you’ll read in this year’s Property Report, we believe Melbourne is one of Australia’s most undervalued markets. For investors willing to move early, this could be a rare opportunity to secure assets ahead of the next growth phase.

We hope Wakelin’s 2025 Property Report provides valuable insights to guide your property investment decisions in 2025 and beyond.

Jarrod McCabe, Director

2024 Trends Shaping 2025

The recovery that never came

2024 was a year that began with cautious optimism in Melbourne’s property market. Many anticipated high interest rates, which had dominated the economic landscape, would finally ease, sparking a market recovery.

However, as we now know, the widely expected rate cuts never materialised. Instead, Melbourne’s market remained languid, with the much-anticipated uplift failing to materialise, and prices actually retracting.

But it wasn’t just interest rates holding Melbourne’s market back. While other capital cities saw property prices increase in the high-rate environment, Melbourne prices were weighed down by additional challenges.

A series of new and incoming State Government taxes and policies hit property investor sentiment particularly hard. For many the squeeze has become untenable, with rising costs and diminished growth, seeing many investors choosing to exit the market.

WHAT IT MEANS FOR INVESTORS

2024 market flat, but didn’t fall

“2024’s market could best be described in a word as lackluster. It lacked clear direction, which was evident in the slight drop in median values. While there was some decline, it wasn’t significant – not the type of sharp downturn typically seen in tougher market conditions.

“This stands in stark contrast to 2018, when the market experienced a clear correction after years of strong growth. Back then, auctions told the story – buyers were out in force, ready to capitalise on stressed vendors, but wouldn’t hesitate to move on to the next property if their price wasn’t met.”

Jordan Telfer

Property Advisor

Investor activity: A stark contrast between Victoria and the national market

Victoria’s subdued investor activity becomes even clearer when compared to the broader national trend, where investment remains strong.

According to CoreLogic, investor loan commitments reached approximately 212,500 nationwide in the year to September 2024, marking an 18.8% increase from the previous 12-month period. However, the bulk of this growth was concentrated in New South Wales, Queensland, and Western Australia – states where property values have been on the rise.

In contrast, Victoria saw only a 5.1% year-on-year increase in investor loans. But more tellingly, at the same time, the number of new investor listings in the state surged, with Victoria recording around 3,800 in October – accounting for 29% of the national total and sitting 10.6% above the previous five-year average.

OPPORTUNITIES AMIDST UNCERTAINTY:

How to position yourself for growth in Melbourne’s 2025 property landscape

Despite the challenges, Melbourne’s property prices avoided significant declines. While values have seen slight reductions, the market has displayed resilience in the face of the considerable headwinds.

As we move further into 2025, the big question is how Melbourne sits from an investment perspective.

Is the market undervalued, has it bottomed out, and is it ready to enter its next growth cycle?

If so, does 2025 present a timely opportunity for investors to act now and position themselves for future gains?

NUMBERS DON’T LIE, BUT THEY CAN MISLEAD

Understanding Melbourne’s property potential

When assessing Melbourne’s property market, it’s essential to look beyond headline figures and dig into the data. Median property prices, often used for comparing capital cities, can sometimes paint a misleading picture, especially for cities with differing property compositions. We explored these issues in Jarrod’s

column for The Australian Financial Review, which highlighted the importance of a nuanced approach to understanding the data.

Melbourne has a significantly higher proportion of apartments compared to smaller cities like Adelaide or Perth. When statistical reports include all dwelling types – houses, units, townhouses, and apartments this broader definition can distort comparisons between cities.

For instance, at the time a CoreLogic report showed that Adelaide’s median dwelling price had overtaken Melbourne’s, with Adelaide’s sitting at $790,000 compared to Melbourne’s $776,000. At face value, this might suggest that Adelaide has become more expensive overall.

However, breaking down the data tells a different story. Melbourne’s median house price remained significantly higher, at $944,000, compared to Adelaide’s $830,000. Similarly, Melbourne’s median apartment price of $610,000 was also substantially higher, compared to Adelaide’s $546,000.

The discrepancy lies in Melbourne’s property composition: apartments make up approximately 33% of Melbourne’s dwellings, while in Adelaide, they account for

only 16%. The greater proportion of lower-priced apartments in Melbourne skews its overall median dwelling price downward, making direct city-to-city comparisons less meaningful without context.

To truly understand Melbourne’s property market, it’s critical to compare ‘like for like’ – houses with houses, apartments with apartments. Doing so reveals a market that remains strong in its fundamentals, even if the top-level statistics tell a more subdued story.

Download the full report for access to strategic buying and selling techniques in Melbourne’s subdued market.

Download for free now

Your Details

Lessons from the past

Looking back to the 1990s, Melbourne’s property market provides a telling precedent. After the early 1990s recession, the market remained stagnant until1997.

This lull was followed by over a decade of robust and sustained growth, which only slowed with the Global Financial Crisis in 2008.

History shows that periods of underperformance often set the stage for significant recovery and growth.

Melbourne’s fundamentals and future potential

Despite this recent stagnation, Melbourne remains one of the most attractive cities for long-term investment. Its strong fundamentals as a global city, with unparalleled economic, educational, and lifestyle advantages make it a desirable place to live, and as such a resilient market.

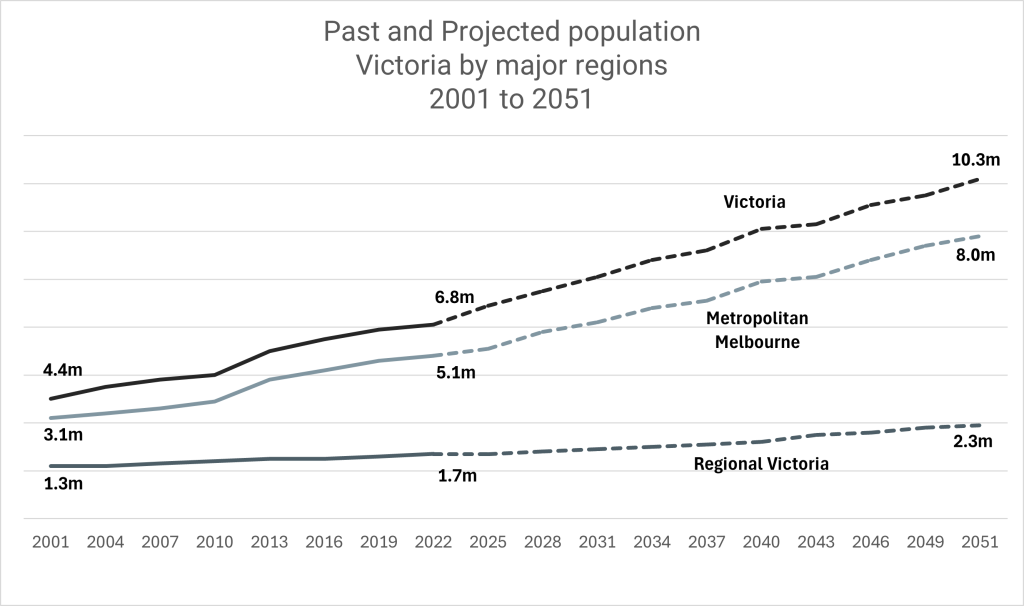

Strong forecasted population growth underpins strong future housing demand – which will eventually squeeze supply, increase competition and inevitably push up prices.

Moreover, the relative underperformance of recent years suggests there maybe significant pent-up demand waiting to be unleashed. As market conditions stabilise and confidence returns, Melbourne will be primed for a period ofstrong growth.

For the full story, download the report here

Download for free now

Your Details