With Melbourne’s Spring selling season approaching, and supply and activity picking up, it provides a valuable time to gauge how the market has progressed over the past six to 18 months. And whether it provides any signals for the city’s upcoming auction season.

Let’s explore some key insights and trends that are set to shape this Spring selling season.

Supply and demand

One of the best starting points is to examine supply levels, and in Melbourne this particularly relates to auction numbers.

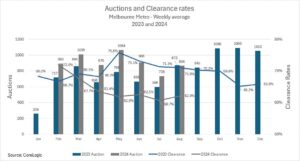

Comparing the average weekly auction numbers from 2023 to 2024 so far, we see a significant improvement in supply. There’s a lot more property on the market, with increases ranging from 17% to 37% per month, according to data from CoreLogic.

While increased supply hasn’t significantly impacted values yet, it’s important to consider how it interacts with demand. The clearance rate held reasonably well through 2023, hovering around 70-75% until November-December, when it dropped to the mid-60s. Leading into the start of 2024, it started strong, following pent-up demand over the Christmas New Year break, sitting at around 70% in the early part of the year. However, it has since fallen back to the early-to-mid 60s due to increased supply.

Opportunities for buyers, less so for vendors

That suggests competition may well-be subdued this Spring. That’s not great news for vendors, but it does provide some great potential opportunities for buyers.

For many who have been priced out over recent years, this selling season may see more avenues open up.

There looks to be potential right across the market, presenting opportunities for all buyer types, including investors, first home buyers, upgraders and downsizers.

The impact of interest rates

Interest rates are another key factor influencing the market. It’s always a dangerous game trying to pick their movements. But, while there’s a slight chance of another rate rise if inflation surges, the general consensus is that rates will likely remain stable this year.

If inflation returns to the Reserve Bank’s target range of 2-3%, many expect interest rates to start decreasing next year. Major banks predict the cash rate, currently at 4.35%, could drop to 3-3.5% by the end of 2025, which would definitely provide some welcome relief to property owners.

Rental laws create investor woes

The Victorian Government’s new rental laws are set to take effect in October 2025. And while noble in their aims to improve conditions for renters, they’re placing increasing pressure on property owners, who are leasing out their properties.

The changes mean rental providers will need to pay for upgrades, such as better insulation, air conditioning, and draft proofing, and improved energy efficiencies. While the government estimates the cost at around $5,000 per property, many investors feel it’s just another expense in a long list of rising costs, in what many are describing as death by a thousand cuts.

Investors tapping out

Melbourne property investors are facing challenges on multiple fronts. They include the aforementioned rental laws, and interest rates, as well as land tax increases, coupled with the relatively stagnant capital growth in property values over the past two to three years.

That’s led to many investors reconsidering their positions in the market, with many deciding to cut their losses and sell.

Vacancy rates and rent increases

Despite the challenges faced by investors, the current low vacancy rates are a positive for those who remain in the market.

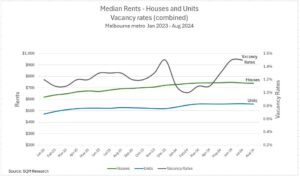

The low vacancy rates, which have hovered between 1% and 1.5% are pushing up rental prices.

Over the past 18 months, rental figures for houses have increased by 19%, and units have seen a 17% rise.

This is providing an increased revenue stream for investors, partially balancing the increased costs. This trend is likely to continue if the supply of rental properties remains limited.

Potential for investor turnaround

The trend points to some potential light on the horizon for investors, with a potential turnaround a significant possibility.

If interest rates decrease as predicted next year, and rental prices continue to rise, this could entice some investors back into the market.

This will definitely be worth monitoring as we move through into next year. However, for now, the majority of investors are leaving, and the market remains subdued.

First home buyers filling the gap

Interestingly, many of the properties that are being sold by investors are being purchased by first-home buyers.

This could potentially ease some of the pressure on the rental market, as these buyers may have previously been renters.

However, it also means that first-home buyers and investors are competing for the same types of properties, typically entry-level properties, which could further drive up prices in this segment of the market.

Take home message

While this Spring may not be bountiful for vendors, it promises exciting buying opportunities for those looking to purchase.

However, patience and prudent asset selection remain crucial, particularly when choosing properties amid a wide range of options.

Remember to think long term, and prioritise properties that meet predetermined goals, rather than the cheapest available option.

Long term capital growth will far outweigh a sub-par asset, even if it was bought at a bargain price.